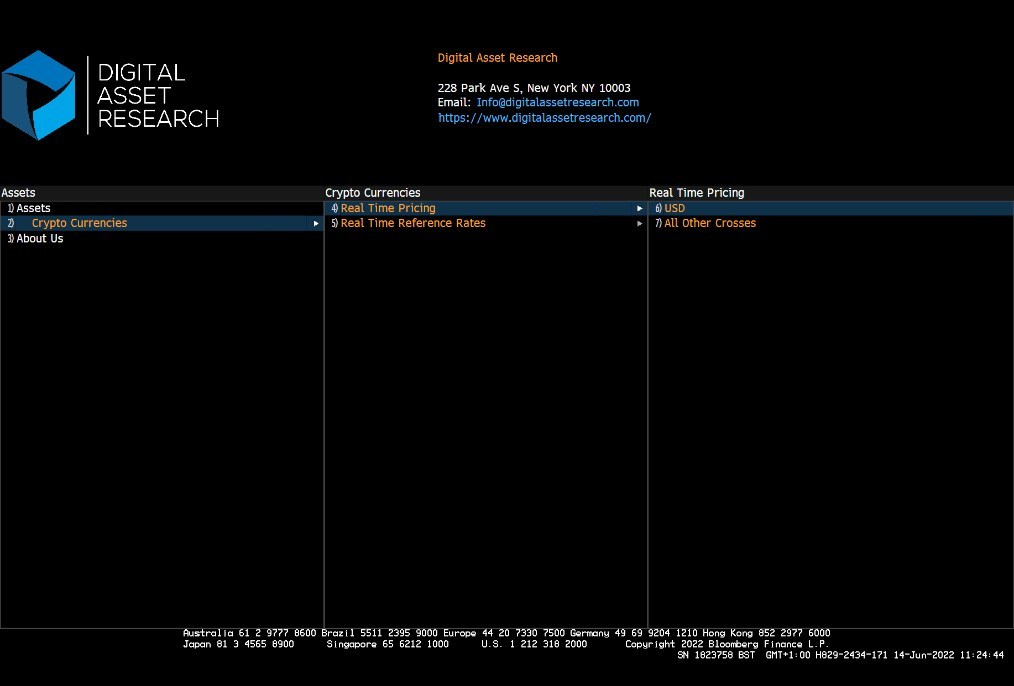

Partnership with Bloomberg allows Terminal users to access DAR ticking and end of day pricing data, quoted in fiat crosses.

NEW YORK, June 21, 2022 — Digital Asset Research (DAR), a leading provider of ‘clean’ crypto asset data, insights, and research, today announced a partnership with Bloomberg to supply intraday and hourly crypto asset prices for 50 crypto assets to Bloomberg’s 325,000 Terminal users.

Intraday prices, which are calculated every second and priced in the quote currency of the trading pair, are found on the Terminal as “DAR”. Similarly, hourly and end of day prices, which are calculated at the top of each hour and priced in the quote currency of the trading pair, are found on the Terminal as “DARR”.

Timely access to ‘clean’ crypto data, including historical prices as far back as when these assets started trading on selected DAR Vetted and Watchlist exchanges, allows Bloomberg Terminal users to better understand crypto markets, evaluate opportunities, and measure risks.

“We are pleased to help expand crypto coverage on the Bloomberg platform and bring greater trust to this part of the market by delivering digital asset prices that are designed to set institutional standards for transparency, quality, and accuracy,” said Doug Schwenk, DAR’s CEO.

Prices for each crypto asset are quoted in seven fiat crosses including United States Dollar (USD), Australian Dollar (AUD), Euro (EUR), Pound Sterling (GBP), Japanese Yen (JPY), Canadian Dollar (CAD) and Singapore Dollar (SGD). DAR calculates fiat crossing prices by aggregating matching pairs collected from its Vetted and Watchlist exchanges.

Each quarter, DAR identifies its Vetted and Watchlist Exchanges by evaluating crypto exchange price quality through an extensive quantitative review of trade and order book data, looking for signs of data manipulation or market manipulation through their fraud detection and market surveillance techniques. Additionally, qualitative diligence is undertaken to ensure exchanges are taking appropriate steps to prevent future abuse. More on DAR’s vetting process can be seen here.

DAR pricing data is live on the Bloomberg Terminal for the following 50 assets: Aave (AAVE), Algorand (ALGO), Avalanche (AVAX), Axie Infinity (AXS), Basic Attention Token (BAT), Binance Coin (BNB), Bitcoin (BTC), Bitcoin Cash (BCH), Cardano (ADA), Chainlink (LINK), Cosmos (ATOM), Cronos (CRO), Curve DAO Token (CRV), Dai (DAI), Dash (DASH), Decentraland (MANA), Dogecoin (DOGE), Elrond (EGLD), Enjin Coin (ENJ), EOS (EOS), Ethereum (ETH), Ethereum Classic (ETC), Fantom (FTM), Filecoin (FIL), Flow (FLOW), FTX Token (FTT), Hedera (HBAR), Internet Computer (ICP), Litecoin (LTC), IOTA (MIOTA), Maker (MKR), Monero (XMR), Polkadot (DOT), Polygon (MATIC), Shiba Inu (SHIB), Solana (SOL), Stacks (STX), Stellar (XLM), Terra (LUNA), TerraUSD (UST), Tether (USDT), Tezos (XTZ), The Sandbox (SAND), TRON (TRX), Uniswap (UNI), USD Coin (USDC), VeChain (VET), Wrapped Bitcoin (WBTC), XRP (XRP), and Zcash (ZEC).

Bloomberg follows a rigorous vetting model that includes assessments of institutional custody support, trading access, market capitalization, and consistency of turnover to select the assets that are on the terminal, according to the recent announcement about its crypto asset coverage expansion.

DAR also offers a Reference Data Master that provides security-master data on assets and exchanges; a Crypto Events Calendar that tracks events impacting assets such as software updates, forks, and airdrops; an Industry Taxonomy that organizes the digital asset landscape by use case, underlying technology, and theme; Blockchain Data, which includes network metrics and transaction details; and Yield Data (in beta) with details on current and historic yield rates. For more information, please visit https://www.digitalassetresearch.com/.