Responding to increased market interest in advance of the next demand wave, asset managers are using this crypto winterto build new crypto-related offerings.

Overview

Crypto is a nascent asset class that has seen multiple boom-and-bust cycles over the last decade. While interest in crypto might rise and fall based on market cycles, the technological innovations of the asset class continue to show promise and garner institutional interest globally.

The ongoing crypto winter combined with the cooling macroeconomic environment and increasing regulatory clarity present an opportunity for managers to build out their offerings, in anticipation of the next demand wave for crypto assets. Crypto Exchange-Traded Products (ETPs) are one expanding area of the market to watch.

Introduction to Crypto ETPs

Crypto ETPs are popular methods for investors to gain exposure to crypto assets. For institutional investors, Crypto ETPs are arguably one of the most compliant ways to hold digital assets and also help to reduce counterparty risk. Without Crypto ETPs, investors would need to directly hold the underlying crypto assets and interact with lightly regulated trading platforms, which introduces security, counterparty, and regulatory risks, as well as more complex tax reporting.

Crypto ETP offerings are also expanding as product sponsors are utilizing the relatively quieter time in crypto as an opportunity to build out and expand their offerings. This means that the Crypto ETP space is quickly adapting to recent technological changes, such as Ethereum’s shift to Proof-of-Stake, while simultaneously preparing for the next market cycle.

Digital Asset Research (DAR) publishes monthly Crypto ETP reports. Coming out of our most recent ETP report, we are highlighting key data on Crypto ETP demand, the current state of the market, and trends.

State of Crypto ETPs

In the following section, we showcase charts and data from our latest ETP report.

There are numerous types of Crypto ETPs, but they can be primarily categorized as single or multi-asset products. Single asset ETPs track one asset, like Bitcoin, while multi-asset ETPs track more than one asset, such as a DeFi ETP that might be composed of many DeFi assets.

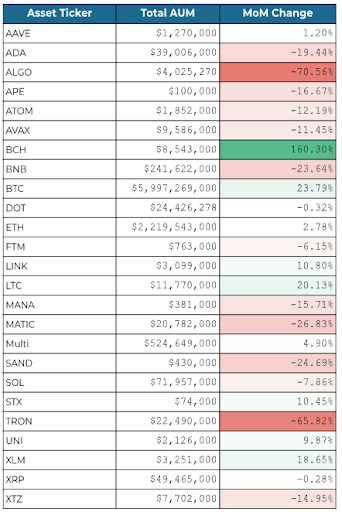

Single-asset ETPs, primarily ETPs that track Bitcoin and Ethereum, dominate the large majority of Crypto ETP assets under management (AUM). At the end of June 2023, Bitcoin ETPs held more than $5.9B in AUM and Ethereum ETPs held more than $2.2B in AUM; by contrast, multi-asset ETPs held approximately $520M in AUM. See how AUM in Crypto ETPs compares across assets and multi-asset products in the chart below.

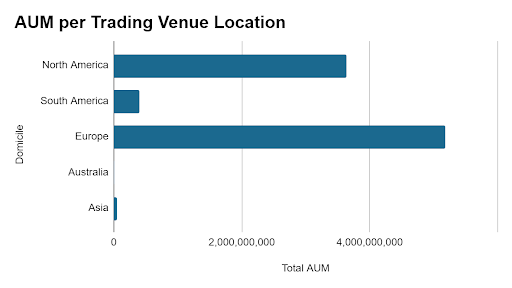

The large majority of crypto ETPs are traded on venues based in Europe. More than $4B in AUM is based in Europe, with jurisdictions such as Sweden and Switzerland seeing the most AUM. Australia sees the least amount of AUM based on where ETPs are traded.

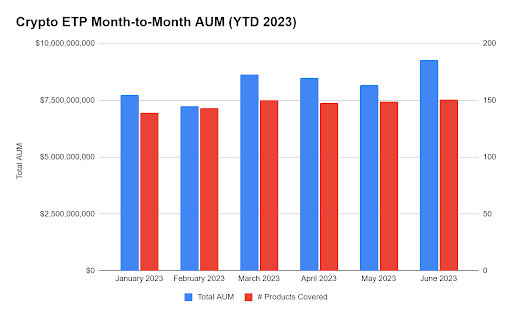

In the past six months, the total AUM of crypto ETPs has grown from ~$7.75B in January 2023 to ~$9.26B in June 2023. (During the same period, the number of products considered in the data set has grown from 139 to 151.)

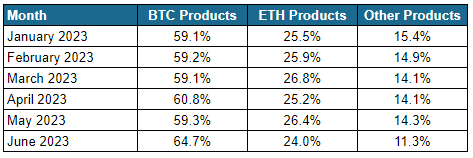

Bitcoin ETPs saw a significant increase in their share of total ETP AUM in June 2023 as a slew of spot Bitcoin ETF filings were submitted by notable institutions.

Share of ETP AUM by Asset Per Month

Crypto ETFs in the United States

Now that we’ve presented the state of crypto ETPs globally, let’s go one layer deeper and address crypto ETPs in the United States. Thus far, the only crypto ETPs approved in the U.S. are futures-based ETF products that track crypto derivative prices instead of underlying crypto assets.

Due to the limited size of the futures market and the possibility of the derivative having a price mismatch with its underlying crypto asset, numerous product sponsors have tried to launch a spot crypto ETF product in the U.S. However, the U.S. Securities and Exchange Commission (SEC) has not yet approved any applications for a spot crypto ETF for a number of reasons, including a lack of ability to conduct proper surveillance on the spot market used to price the ETP and not being able to ensure the spot market’s resistance to price manipulation.

The most notable example is Grayscale’s effort to launch a spot crypto ETF. Grayscale is the largest crypto asset management firm with more than $22 billion in AUM across its offerings. The firm filed to convert its Grayscale Bitcoin Trust product (GBTC) into a spot-based Bitcoin ETF in the U.S. This effort, however, was rejected by the SEC in June 2022. Since then, Grayscale has sued the SEC over the regulator’s rejection.

As the Grayscale lawsuit is ongoing, the next key date to pay attention to is a final decision from the D.C. Circuit Court of Appeals, which will happen some time in Q2 2023 or later. The full timeline is available on Grayscale’s website.

The significance of Grayscale’s suit against the SEC is that it could pave the way for the approval of a spot Bitcoin ETF in the United States. If the court rules in Grayscale’s favor, it would send a strong signal to the SEC that it should approve spot Bitcoin ETFs.

Other than Grayscale, 8 other firms have filed (or refiled) for a Bitcoin ETF in 2023, including BlackRock, the world’s largest asset manager with $10 trillion in assets under management.

The introduction of a spot Bitcoin ETF in the U.S. would be a major milestone for the cryptocurrency industry. It would make it easier for investors to access Bitcoin and could help to legitimize cryptocurrency and digital assets as a mainstream investment.

Crypto ETPs and What Comes Next

The growth of crypto ETPs is a net positive for the asset class as it provides a method for investors to participate in the crypto markets with relatively less counterparty, security, or regulatory risks. As the regulatory environment matures, crypto ETPs are seen as a way to catalyze growth and innovation, resulting in easier access for interested capital to allocate towards crypto as an asset class.

Crypto ETP Reports

DAR offers monthly Crypto ETP Reports that give comprehensive views with high-quality data. Click to inquire.

YOU ARE RESPONSIBLE FOR DETERMINING WHETHER ANYTHING CONTAINED HEREIN IS SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES, AND FOR SEEKING PROFESSIONAL TAX, LEGAL, AND/OR INVESTMENT ADVICE AS APPROPRIATE. PLEASE SEE THE OTHER DISCLAIMERS AT THE END OF THIS REPORT.